To check if you need to pay Capital Gains Tax you need to work out your gain for each transaction you make. AGPL-30 License Releases 15 tags.

Best Bitcoin Tax Calculator In The Uk 2021

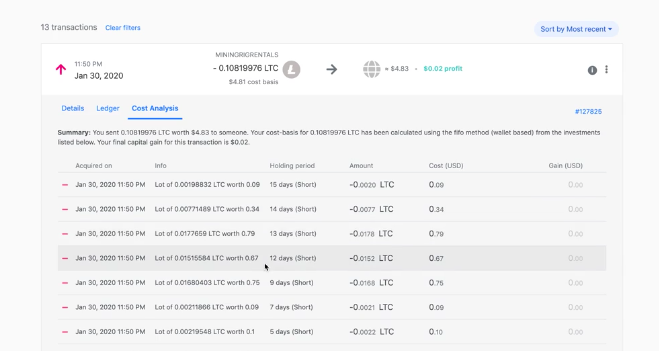

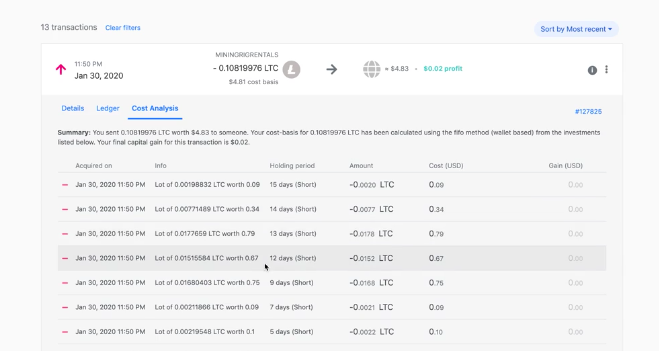

To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions.

Crypto tax calculator uk. The Ultimate UK Crypto Tax Guide 2020. First on the list is England based crypto portfolio and tax calculator Koinly. Whilst cryptocurrency is a relatively new asset the regulations surrounding it are still being formed.

Investors traders miners and thieves. Are you prepared for tax season. Over the last decade cryptoassets have burst on to the investment scene and captured the imagination of investors all over the world.

UK Crypto Tax Guide 2020 The tax collecting body of the UK HMRC Her Majestys Revenue and Customs has started to more aggressively enforce its crypto tax policies. The original software debuted in 2014. HMRC doesnt consider cryptoassets to be a form of money whether exchange tokens utility tokens or security tokens.

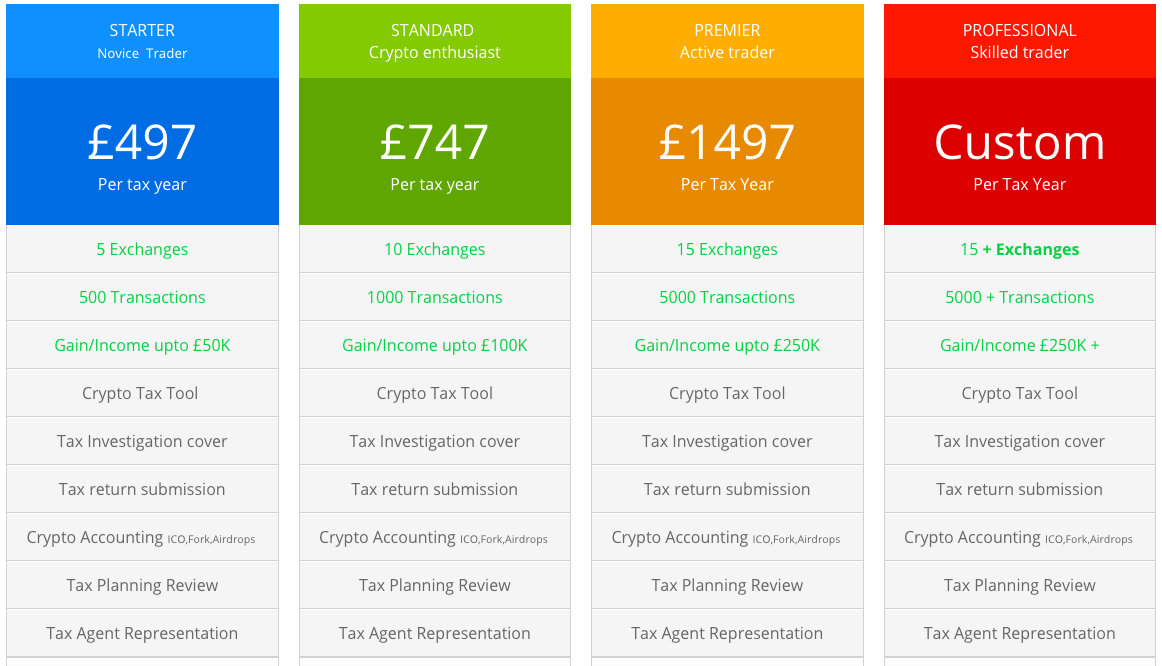

TaxScouts is a team of accountants who can help you file your tax form for just 119. This tax solution has in a short time become very popular in the UK and is today used by several thousand individuals to make it simple to calculate and report their crypto taxes. Dont forget about your allowance.

You can also generate an Income report that shows your income from Mining Staking Airdrops Forks etc. Read The Ultimate Crypto Tax Guide. That means you calculate your capital gains and if the result is below the limit you dont need to pay any capital gains tax.

You pay 127 at 10 tax rate for the next 1270 of your capital gains. Capital gains tax only has to be paid if you made over 12000 increased to 12300 for tax year 2020-2021 in profits. Our software is designed to support the unique HMRC reporting requirements including UK specific rules around mining staking and airdrops.

Demystify Crypto Taxes All blog post Tag. Capital gains tax CGT breakdown. How to calculate your UK crypto tax Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC.

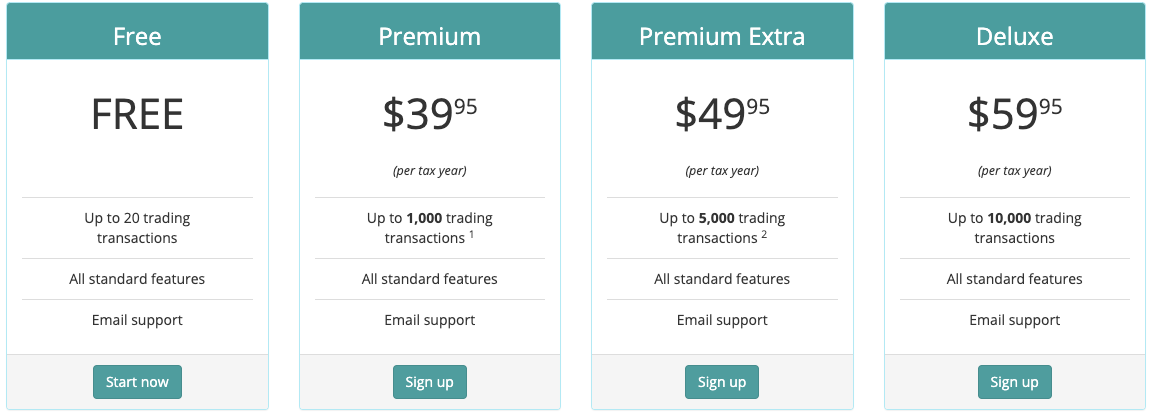

If you have less than 100 cryptoasset transactions per year it may be worthwhile to pay the price of 39 per year to double-check if all of your crypto taxes are in order. Crypto Tax Calculator Use the Calculator. 99 for all financial years.

With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. Best crypto tax calculators to use in the UK TaxScouts. Koinly is a cryptocurrency tax calculator that can easily import your crypto transactions and calculate your capital gains in accordance with the HMRC and Share Pooling rules.

CoinTrackinginfo - the most popular crypto tax calculator. Since then its developers have been creating native apps for mobile devices and other upgrades. UK crypto tax crackdown On top of the previously released guidance the HMRC reached an agreement with Coinbase to disclose information on its users with more 5000 worth of crypto assets on the platform during the 2019-20 tax year.

6 months later she bought 05 BTC for 2000. As cryptocurrencies like bitcoin have grown in popularity over the years so has the amount of people who are making money by investing or trading them. As with any investment it is subject to tax rules.

The way you work out your gain is different if you sell tokens within 30. Get help with your crypto tax reports. You pay 1286 at 20 tax rate on the remaining 6430 of your capital gains.

This guide breaks down the UKs cryptocurrency tax rules so that you can easily comply with them. Crypto Tax Calculator is one of them designed specifically for HMRC tax laws. Log in Sign Up.

You can easily import all transactions from exchanges like Coinbase and Binance automatically and generate your crypto tax reports with the click of a button. Online Crypto Tax Calculator with support for over 65 exchanges. Crypto-currency tax calculator for UK tax rules.

As the cryptosphere gained more traction revenue authorities came knocking and started talking about the need for crypto traders and investors to pay tax. So is there a crypto tax in the UK. Natalie bought 1 BTC for 1000.

Koinly operating since 2018 and now became a leading cryptocurrency tax service that developed in collaboration with renowned tax consultants from KPMG one of the big four accounting organizations to ensure all generated reports are compliant with relevant tax laws of over 20 countries. Crypto bitcoin united-kingdom tax cryptocurrency tax-calculator hmrc cryptoasset capital-gains tax-calculations cryptotax tax-reports Resources. Discover how much taxes you may owe in 2021.

CoinSutra Cryptocurrency 6 Best Crypto Tax Softwares 2021 Calculate Taxes on Crypto Cryptocurrencies brought four main groups together. This is a local company that knows all ins and outs in order to stick to all the regulations we have in our kingdom. File your crypto taxes in UK Koinly helps UK citizens calculate their crypto capital gains.

You pay no CGT on the first 12300 that you make. However when it comes to taxing them it depends on how the tokens are used. We support the Same Day and Bed Breakfast wash sale rules.

Tax doesnt have to be taxing.

Best Bitcoin Tax Calculator In The Uk 2021

Best Bitcoin Tax Calculator In The Uk 2021

Uk Cryptocurrency Tax Guide Cointracker

Best Bitcoin Tax Calculator In The Uk 2021

![]()

Cointracking Crypto Tax Calculator

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

0 Comments